PTO

MADATE

- Inform and advises the Governor, SP and other stakeholders regarding fiscal and financial matters of the Province.

- Imposes and collects tax and other charges as embodied in the RA 716, Revised Revenue Code and other ordinances of the Province.

- Takes custody and supervision of all provincial funds as well as the proper application/disbursement of the same.

- Exercise technical supervision and control over all municipal treasury offices under the jurisdiction of the Province.

- Intensifies and enhances collection activities of Real Property Tax and other Income/receipts at the municipal resources of the Province.

- Capacitate treasury personnel of all levels of LGUs (Barangays, Municipalities and the Provincial Office) by providing program for trainings in order to

- improve efficiency and effectiveness in the delivery of vital services to the public.

- Improves efficiency and effectiveness of treasury operations/services by reducing unnecessary paper works and processes.

VISION

An efficient and progressive organization for fiscal and financial administration and management particularly in the collection, custody and disbursement of funds, with responsible accountable, competent and approachable personnel to support the provincial government o Davao Del Sur achieve its financial goals and objectives.

MISSION

To generate revenues through efficient collections of taxes, fees and charges accruing to the province in accordance with existing laws and ordinances and to take custody and exercise proper management of the funds in order to sustain and maintain financial needs of the Province and Development of its manpower to be more competent and responsive to the needs of people it serves.

SERVICE PLEDGE

As civil servants, we, at the Provincial Treasurer’s office, are steadfast in our commitment to the Code of Conduct and Ethical Standards for public servants, and thus promise to serve our people with respect, dignity, loyalty and integrity. Imploring the aid of the Almighty, we shall dedicate ourselves in the prompt performance of our respective duties and responsibilities. We shall also champion the promotion of a transparent and accountable governance to serve our people more efficiently and effectively. In order to promote the welfare of the people, we shall do so in accordance with the fundamental values set forth by the Republic Act No. 6713. This is our pledge to the people of the Province of Davao Del Sur.

FRONTLINE SERVICES

Cash Receipts Division

- Receives and collect all kinds of taxes, fees, charge and all other impositions accruing to the province-real property taxes; business taxes; other local taxes; other revenues from economic enterprises; various fees, charges and impositions due from taxable persons/entities; and other monies due and collectible by the national/provincial/city/municipal governments.

Cash Disbursement Division

- Withdraws cash needed for payment of various claims and obligations

- Prepares checks for payment of various claims and obligations

- Pays either cash or in checks, all valid claims in consonance with all Commission on Audit (COA) rules and regulations

Revenue Operations Division

- Computes and prepares tax statements

- Post tax payments to individual tax cards from abstract of collections; incorporate changes in data/records of taxpayers/transfer of ownership and other pertinent information

Administrative Division

- Receives, assign and dispatch communications

- Handles procurement of goods and services

- Prepares payrolls, DVs, report on the utilization of gasoline

- Handles distribution, inventory and reporting of Accountable Forms and PPEs

(082) 553 – 2900 / 235 – 4228 / 553 – 2060

(082) 553 – 2900 / 235 – 4228 / 553 – 2060

ACTIVITIES

Seminars

The Department of the Interior and Local Government (DILG)-Region XI, through the Conditional Matching Grant to Province’s (CMGP), and in close coordination with the Provincial Government of Davao del Sur, spearheaded a “SEMINAR ON THE BASICS OF LOCAL TREASURY OPERATIONS AND STRENGTHENING INTERGRITY AND ACCOUNTABILITY OF ACCOUNTABLE OFFICERS TOWARDS FISCAL SUSTAINABLE GOVERNANCE”. In compliance with the IATF protocols, the seminar was held in two (2) separate batches at the Crisbelle Crown Center in Digos City, Davao del Sur, last May 4-5, 2021, and May 6-7, 2021, a total of four (4) days. The participants in attendance included personnel coming from the Provincial Treasurer’s Office and the Municipal/City Treasurer’s Offices. The seminar was graced by Mr. Apollo A. Ebdalin, LTOO IV, and Ms. Sherill S. Daquiz, LTOO III, and Mr. Michael Tagwalan, LYDO III, as resource persons from the Bureau of Local Government Finance (BLGF)- Region XI and DepEd Panabo City Division respectively.

PTO ACCOMPLISHMENT

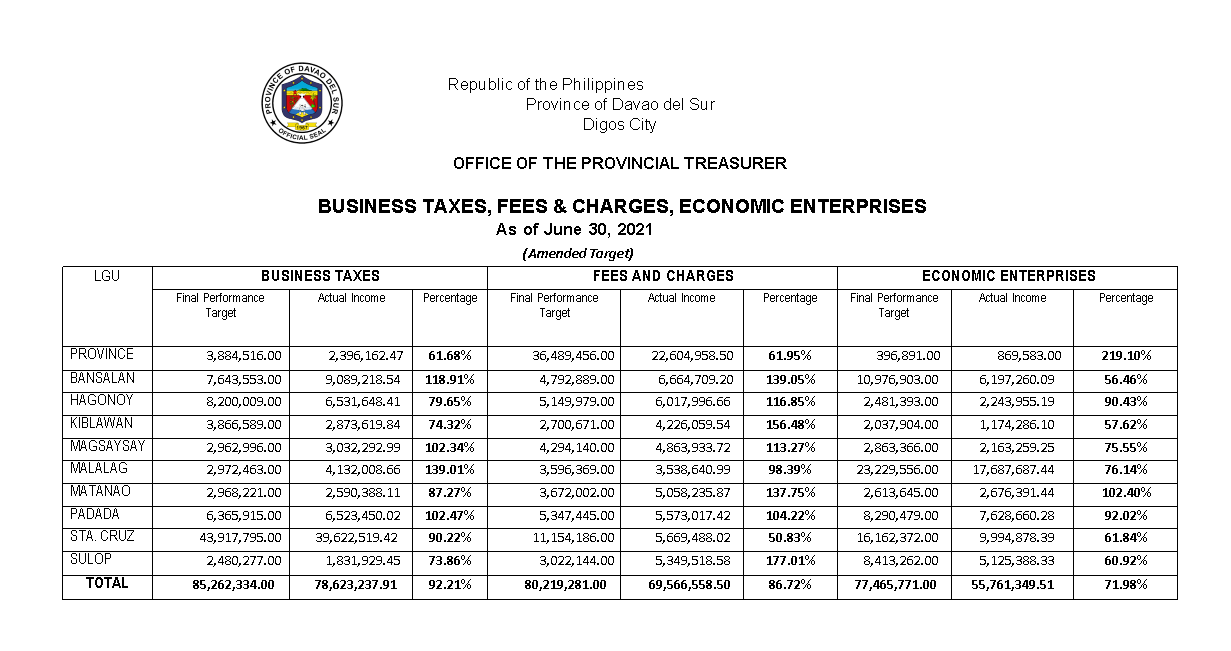

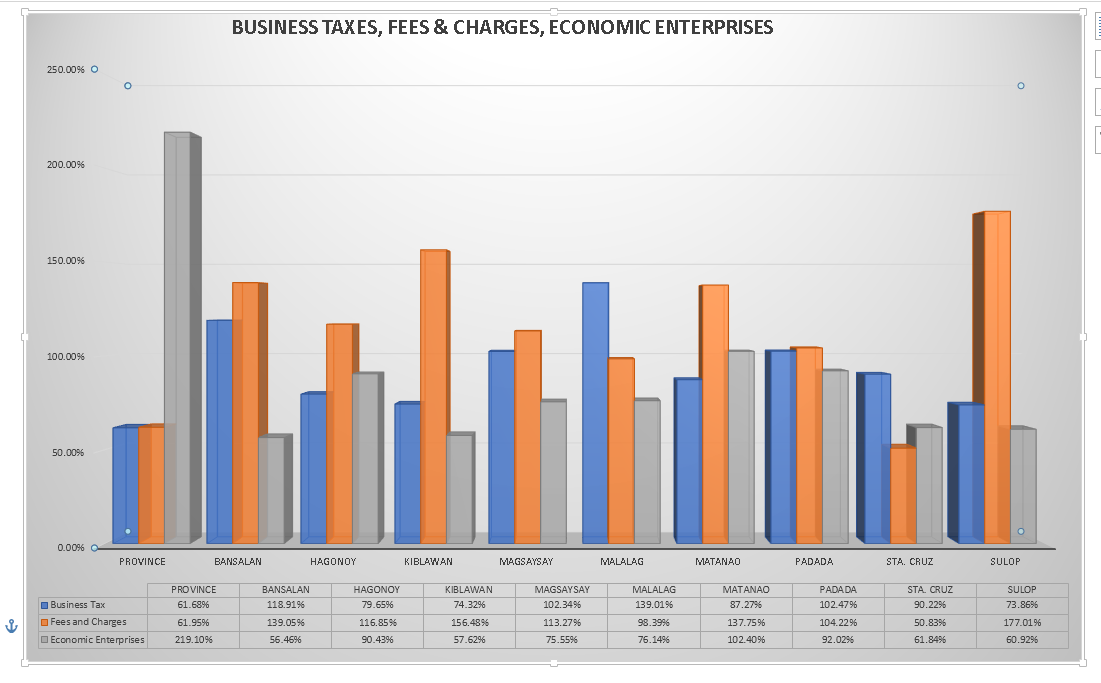

The quarter ending June 30, 2021 report of income from business taxes, fees and charges, and economic enterprises of the Provincial Government of Davao del Sur and different municipalities in the province shows that despite the current situation of COVID-19 Pandemic, have high collection efficiency in all local sources of revenues. These showed that despite the hindrances with the COVID-19 Pandemic, each Local Government Units (LGUs) of the province of Davao del Sur are committed to reaching their revenue targets.

The revenue for business taxes from the municipality of Malalag, Bansalan, Padada, and Magsaysay has a collection efficiency of 139.01%, 118.91%, 102.47%, and 102.34%, respectively. These municipalities are commendable in having an efficiency rating of more than 100% as of the second (2nd) quarter of 2021. Moreover, the municipalities of Sta, Cruz, Matanao, and Hagonoy have an efficiency rating of more than 75%. Additionally, the other LGUs are likewise commendable having more than 50% efficiency rating as of the 2nd quarter of 2021.

Almost all of the LGUs in the province of Davao del Sur have exceeded their goal in the receipts of fees and charges. These LGUs are Sulop – 177.01%, Kiblawan – 156.48%, Bansalan – 139.05%, Matanao – 137.75%, Hagonoy – 116.85%, Magsaysay – 113.27%, and Padada – 104.22%. The municipality of Malalag almost reached its goal having a 98.39% efficiency rating. The other LGUs are still excellent, with their income efficiency having reached higher than 50% as of the 2nd quarter of 2021.

Only two (2) LGUs in the province of Davao del Sur have surpassed the set targets of their income from economic enterprises, namely the Province of Davao del Sur and Matanao, have an efficiency rating of 219.10% and 102.40% respectively. Padada, Hagonoy, Malalag, and Magsaysay have an efficiency rating of higher than 75%. The rest of the LGUs have an efficiency rating of more than 50%.

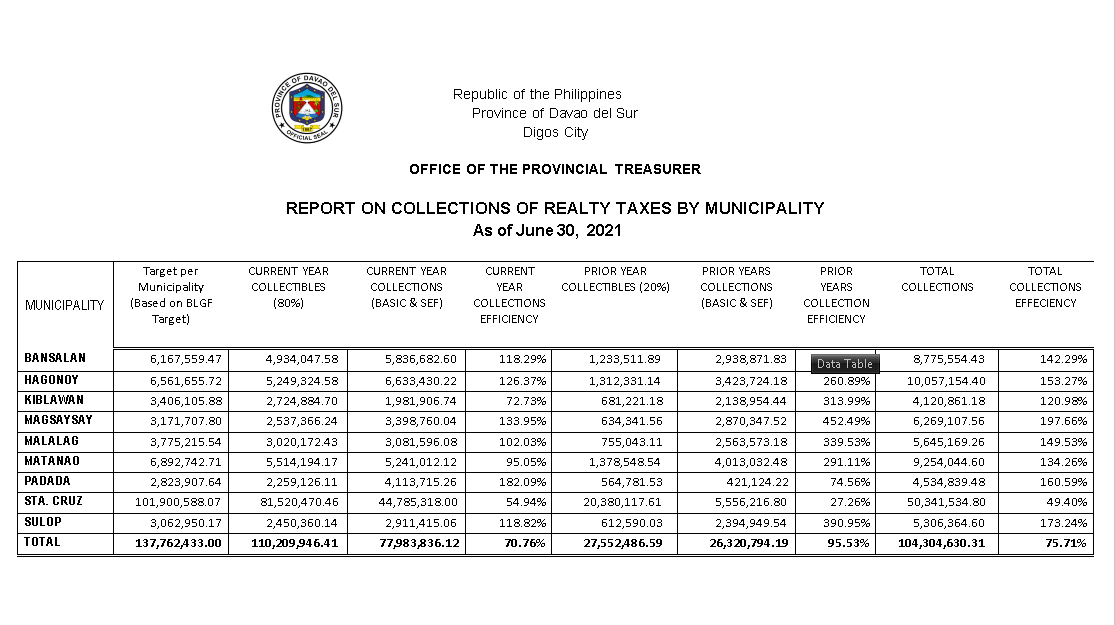

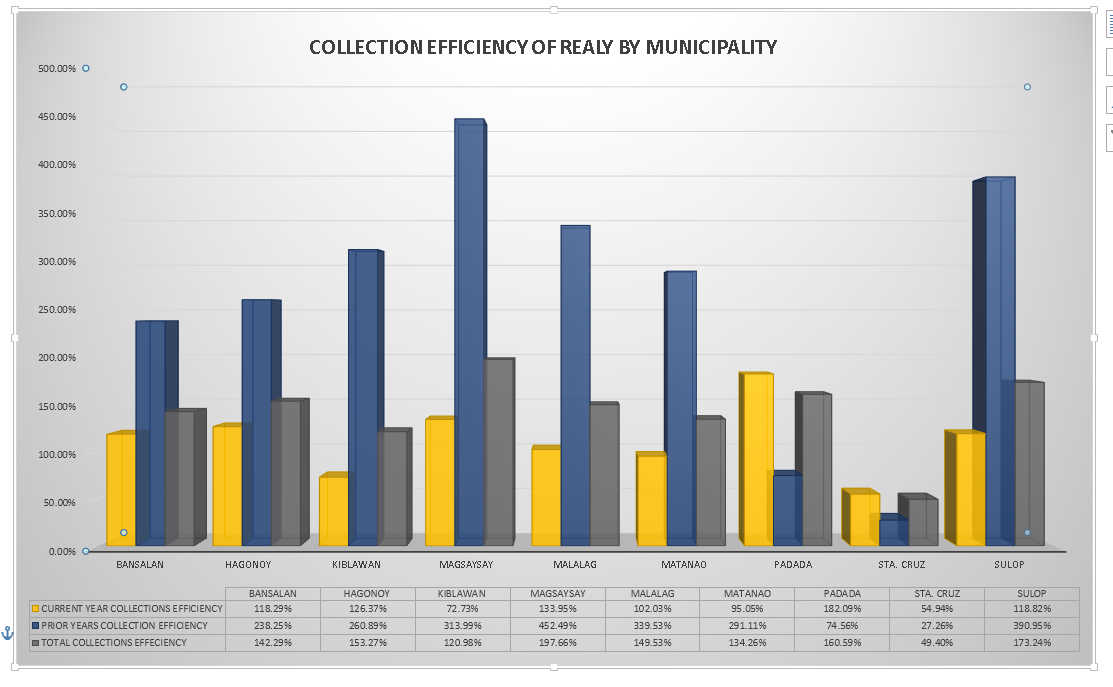

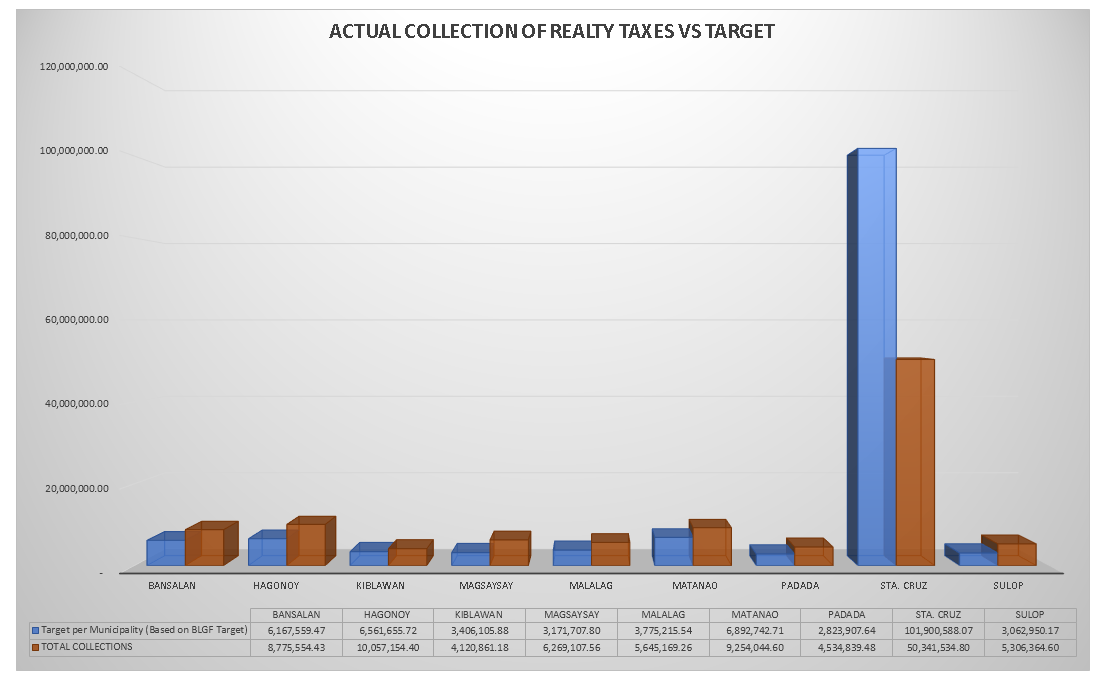

Most LGUs in the province of Davao del Sur have exceeded their set target in the collections of Real Property Taxes as of the 2nd quarter of 2021. The municipality of Magsaysay being the highest with an efficiency rating of 197.66%, almost double of its set target, followed by the municipality of Sulop – 173.24%, Padada 160.59%, Hagonoy 153.27%, Malalag – 149.53%, Bansalan – 142.29%, Matanao – 134.26% and Kiblawan – 120.98%. However, only the municipality of Sta. Cruz has achieved an efficiency rating below the average, only reaching a rating of 49.40% as of the 2nd quarter of 2021.

Overall, the accomplishments of all LGUs in the province of Davao del Sur in maintaining or even surpassing the minimum requirement are beyond excellent. The provincial government of Davao del Sur, especially the Provincial Treasurer, is grateful and greatly appreciates the efforts extended by each Municipal Treasurer of LGUs. Despite COVID-19 Pandemic, the Municipal Treasurer and their local chief executive remain motivated to perform their duties and responsibility towards achieving their goals. Thus, it is difficult but never impossible.

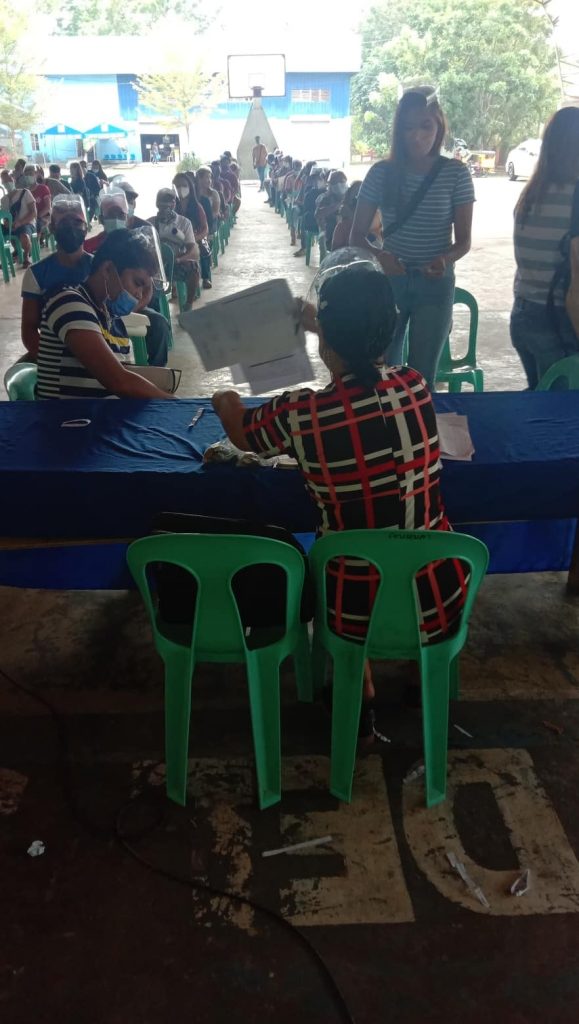

PAYOUT FOR GIP RECIPIENTS

In support of the programs and activities of the Provincial PESO headed by the PESO Manager Rolly M. Impas, LPT, JD, MBA, the Office of Provincial Treasurer has released the cash assistance for the beneficiaries under the Government Internship Program (GIP) of the Department of Labor and Employment (DOLE) in partnership with the Provincial Government of Davao del Sur. The total cash assistance released for August is P2,074,248.00 for 268 grantees from nine municipalities and one city. Each beneficiary is receiving an amount of P8,316.00..

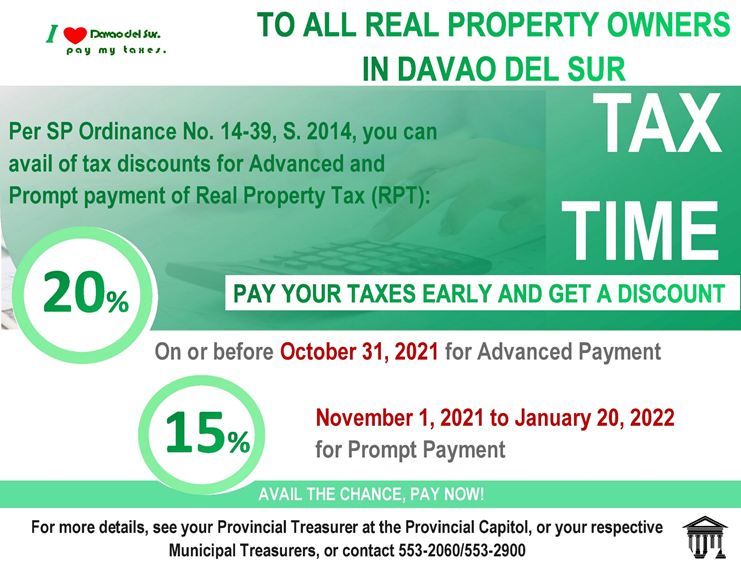

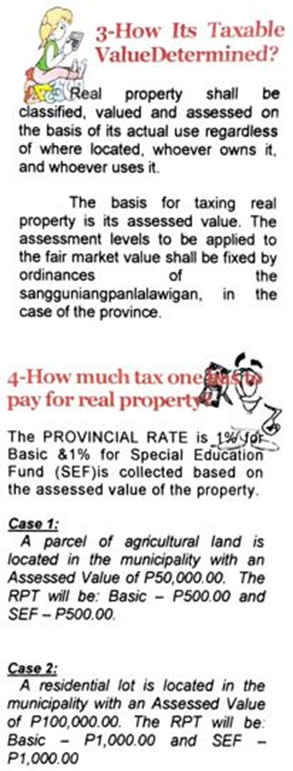

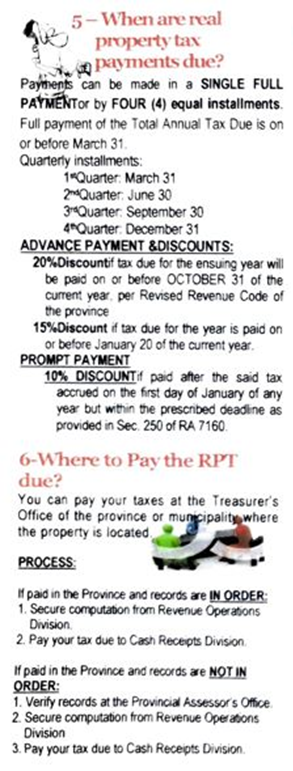

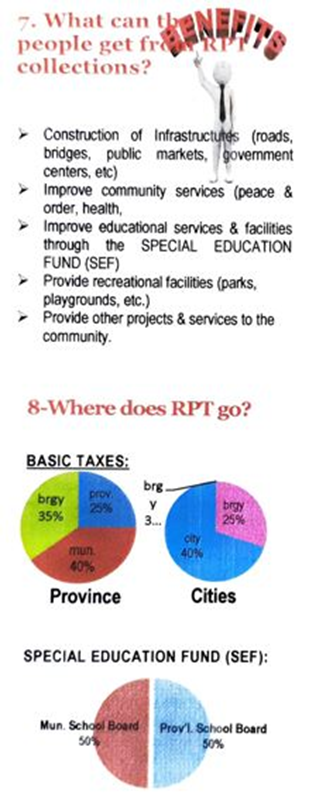

TO ALL REAL PROPERTY OWNERS IN DAVAO DEL SUR

Taxpayers, pay your taxes early and get tax discounts for advanced and prompt payment of Real Property Tax. Take advantage of this opportunity to pay your taxes early to avoid penalties.

Pay your taxes at the Provincial Treasurer’s Office in the Provincial Capitol or at your respective Municipal Treasurer’s Office. Please remember to follow the minimum health protocols.

AVAIL THE CHANCE. PAY NOW!

PAYOUT FOR GOVERNMENT INTERNSHIP PROGRAM

OCTOBER 14, 2021

OCTOBER 14, 2021 – PAYOUT FOR GOVERNMENT INTERNSHIP PROGRAM (GIP) RECIPIENTS

In relation to the programs and activities of the Provincial PESO headed by the PESO Manager Mr. Rolly M. Impas, LPT, JD, MBA, the Office of Provincial Treasurer has released the cash assistance for the beneficiaries under the Government Internship Program (GIP) of the Department of Labor and Employment (DOLE) in partnership with the Provincial Government of Davao del Sur. The total cash assistance released for the month of September is P 1,422,036.00 for 172 grantees. Each beneficiary is receiving a maximum amount of P 8,316.00. The beneficiaries are from the following:

LGU/OFFICE NUMBER OF GRANTEES

DIGOS 28

MALALAG 2

BANSALAN 2

SULOP 1

HAGONOY 3

PESO 126

DOLE 10

#WeLoveDavaodelSur

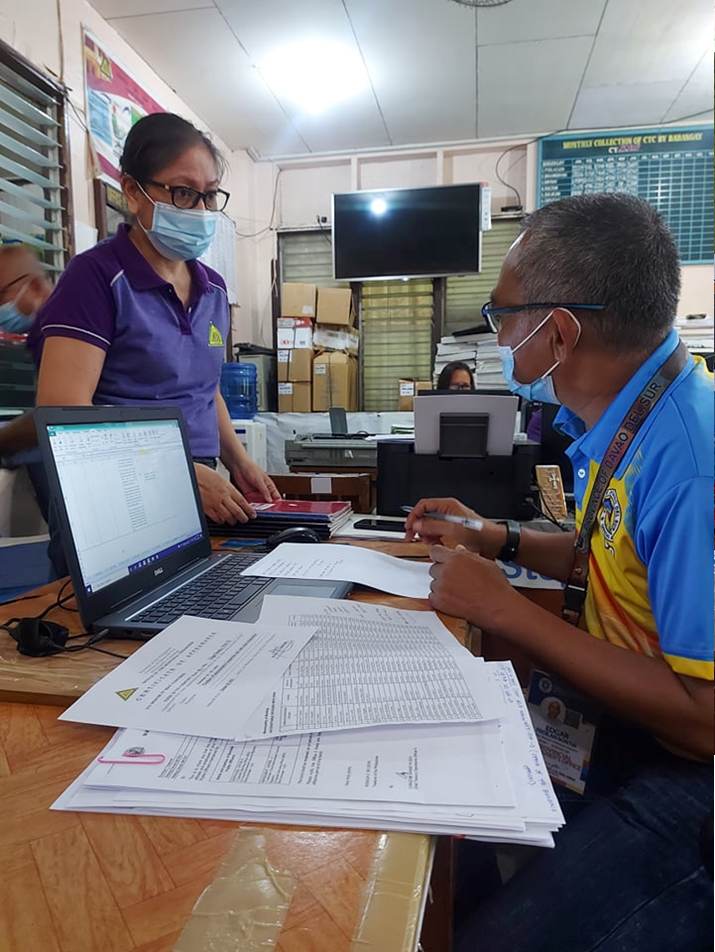

ANNUAL ADMINISTRATIVE INSPECTION AND CASH COUNT EXAMINATION TO DIFFERENT LOCAL GOVERNMENT UNIT IN THE PROVINCE OF DAVAO DEL SUR

Under item no. 2 of the Financial Accountability and Discipline of Annual Plans and Programs, the Provincial Treasurer’s Office is mandated to conduct revenue audit and administrative inspection of all local government units and district hospitals.

The Provincial Treasurer’s Office issued office order no. 16 series of 2021, ordering the two audit teams to conduct an administrative inspection and exercise technical supervision over cash accounts of all Municipal Treasurer’s Office, including City Treasurer’s Office in Davao del Sur.

Team A is composed of Sir Edgar Bontia, LTOO IV, team leader, with Sir Astrophel Celso Gonzales, RCC III, and Ms. Lovely Facultad, LTOO II, as members.

Team B is composed of Sir Edgardo Porlares, LTOO III, team leader, with Sir Rowell Bacongco, LTOO IV, and Sir Nerf Dave Ladroma, LTOO III, as members.

From Monday to Wednesday, October 18-20, 2021, Team A audited the Municipal Treasurer’s Office of the Municipal Government of Malalag. First, the audit team paid a courtesy call to the Honorable Mayor Peter Paul T. Valentin, represented by the Municipal Administrator. Present throughout the audit is Ms. Ruth Medez, Municipal Treasurer. Moreover, the audit team A distributed notice of delinquent real property taxes to the taxpayer’s.

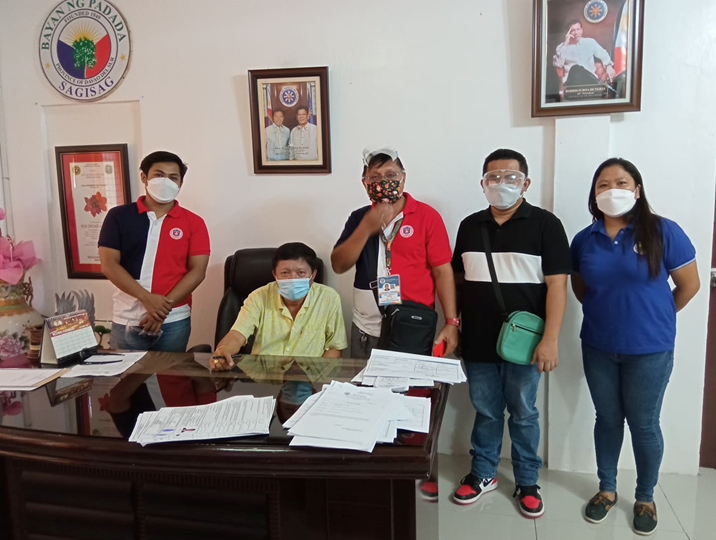

ANNUAL ADMINISTRATIVE INSPECTION AND CASH COUNT EXAMINATION TO DIFFERENT LOCAL GOVERNMENT UNIT IN THE PROVINCE OF DAVAO DEL SUR

Under item no. 2 of the Financial Accountability and Discipline of Annual Plans and Programs, the Provincial Treasurer’s Office is mandated to conduct revenue audit and administrative inspection of all local government units and district hospitals.

The Provincial Treasurer’s Office issued office order no. 16 series of 2021, ordering the two audit teams to conduct an administrative inspection and exercise technical supervision over cash accounts of all Municipal Treasurer’s Office, including City Treasurer’s Office in Davao del Sur.

Team A is composed of Sir Edgar Bontia, LTOO IV, team leader, with Sir Astrophel Celso Gonzales, RCC III, and Ms. Lovely Facultad, LTOO II, as members.

Team B is composed of Sir Edgardo Porlares, LTOO III, team leader, with Sir Rowell Bacongco, LTOO IV, and Sir Nerf Dave Ladroma, LTOO III, as members.

From Wednesday to Friday, October 27-29, 2021, Team B audited the Municipal Treasurer’s Office of the Municipal Government of Padada. First, the audit team paid a courtesy call to the Honorable Mayor Pedro F. Caminero. Present throughout the audit is Ms. Roselyn Agor, Municipal Treasurer. Moreover, the audit team B distributed notice of delinquent real property taxes to the taxpayer’s.

SEMINAR-WORKSHOP ON THE RATIONALIZATION OF LOCAL FEES AND CHARGES (LFC) AND DETERMINATION OF REASONABLE RATES USING LFC TOOLKIT

In coordination with the Bureau of Local Government Finance (BLGF) Region XI, the Office of the Provincial Treasurer initiated to conduct a Seminar-Workshop on the Rationalization of Local Fees and Charges (LFC) and Determination of Reasonable Rates using LFC Toolkit on November 3-5, 2021.

The topics discussed are the salient features of DILG-DOF JMC No. 2019-01, DILG-ARTA-DOF JMC No. 2021-01, BLGF MC No. 20-2019, and Local Fees and Charges Toolkit and General Guidelines. Moreover, Resource speakers for the seminar-workshop are Mr. Apollo A. Ebdallin, LTOO IV, and Ms. Sherill S. Daquiz, LTOO III.

The Seminar-workshop was attended by the members of the Provincial Oversight Committee on the Revision of Fees and Charges and Technical Working Group, and the City and Municipal Treasurers of the Province of Davao del Sur.

Objectives of the seminar-workshop are to

- Orient the participants on the salient features of the DILG-DOF JMC No. 2019-01, BLGF MC No. 20-2019 and DILG-ARTA-DOF JMC No. 2021-01;

- Familiarize the participants of the step by step procedures and detailed instructions in the formulation of LFC Toolkit;

- Create an Oversight Committee on the revision of fees and charges; and

- Enable each LGUs to set reasonable regulatory fees and charges using LFC Toolkit.

AWARDING CEREMONY - Bureau of Local Government Finance (BLGF) Region XI

Awarding Ceremony held on October 29, 2021, through Zoom and Facebook live of the Bureau of Local Government Finance (BLGF) Region XI. BLGF XI Regional Director Pascualito V. Lapiña, DBA, awarded the Province of Davao del Sur through the Provincial Treasurer’s Office headed by Ms. Farah Gemma V. Bidan, CPA. Plaques of Recognition are conferred to the province for achieving the set targets of BLGF in all four (4) major revenue sources.

- Exemplary performance by exceeding the total revenue target in all four major revenue sources, having a collection efficiency of 197.71%.

- Total Revenue Target – P306.070M

- Total Collection – 605.131M

- BLGF XI Roving Trophy for being ranked as 1st place for FY 2020 Real Property Tax Generation having the highest collection efficiency of 326.13%.

- Top performing province by exceeding the Real Property Tax target having a collection efficiency of 326.13%.

- RPT Target – P78.542M

- Actual Collection – 259.411

- Outstanding performance by exceeding the Business Tax target having collection efficiency of 167.03%.

- Business Tax Target – P75.321M

- Actual Collection – 125.810M

- Top performing province by exceeding the Fees and Charges target having collection efficiency of 165.87%.

- Fees and Charges Target – P71.081M

- Actual Collection – 117.900M

- Outstanding performance by exceeding the Economic Enterprise target having collection efficiency of 127.31%.

- Economic Enterprise Target – P80.126M

- Actual Collection – 102.009M

The Province of Davao del Sur has achieved a significant milestone in the intensive implementation of the Revenue Generation Program in exceeding the targets set in all four (4) major revenue sources, namely Real Property Tax, Business Taxes, Fees and Charges, and Economic Enterprises for FY 2020. With this, the Office of the Provincial Treasurer of the Province of Davao del Sur, spearheaded by Ms. Farah Gemma V. Bidan, CPA, is pleased to present these awards to our nine (9) component Municipal Treasury Offices; also, the Provincial Assessor’s Office, headed by Engr. Roderick R. Milana, REA, and the nine (9) component Municipal Assessor’s Offices, the Honorable Governor of the Province, Governor Marc Douglas IV Chan Cagas, and the respective Municipal Mayors, Provincial Local Finance Committee (LFC), and the Sangguniang Panlalawigan (SP) of this Province, as well as to our implementing partners both at the national and local levels. The invaluable and unwavering support, commitment, and collective effort of all stakeholders in sustaining the Province’s Revenue Generation Program’s implementation amidst the COVID-19 Pandemic have resulted in such achievements.

ILOVEDAVAODELSUR!

ANNUAL ADMINISTRATIVE INSPECTION AND CASH COUNT EXAMINATION TO DIFFERENT LOCAL GOVERNMENT UNIT IN THE PROVINCE OF DAVAO DEL SUR - MATANAO

Under item no. 2 of the Financial Accountability and Discipline of Annual Plans and Programs, the Provincial Treasurer’s Office is mandated to conduct revenue audit and administrative inspection of all local government units and district hospitals.

The Provincial Treasurer’s Office issued office order no. 16 series of 2021, ordering the two audit teams to conduct an administrative inspection and exercise technical supervision over cash accounts of all Municipal Treasurer’s Office, including City Treasurer’s Office in Davao del Sur.

Team A is composed of Sir Edgar Bontia, LTOO IV, team leader, with Sir Astrophel Celso Gonzales, RCC III, and Ms. Lovely Facultad, LTOO II, as members.

Team B is composed of Sir Edgardo Porlares, LTOO III, team leader, with Sir Rowell Bacongco, LTOO IV, and Sir Nerf Dave Ladroma, LTOO III, as members.

From Wednesday to Friday, November 10-12, 2021, Team A audited the Municipal Treasurer’s Office of the Municipal Government of Matanao. First, the audit team paid a courtesy call to the Honorable Mayor Vincent F. Fernandez, Represented by the Acting Mayor Frederick Juban. Present throughout the audit is Mr. Camelo Gerwin Melendez, Municipal Treasurer. Moreover, the audit team A distributed notice of delinquent real property taxes to the taxpayer’s.

ANNUAL ADMINISTRATIVE INSPECTION AND CASH COUNT EXAMINATION TO DIFFERENT LOCAL GOVERNMENT UNIT IN THE PROVINCE OF DAVAO DEL SUR - STA. CRUZ

Under item no. 2 of the Financial Accountability and Discipline of Annual Plans and Programs, the Provincial Treasurer’s Office is mandated to conduct revenue audit and administrative inspection of all local government units and district hospitals.

The Provincial Treasurer’s Office issued office order no. 16 series of 2021, ordering the two audit teams to conduct an administrative inspection and exercise technical supervision over cash accounts of all Municipal Treasurer’s Office, including City Treasurer’s Office in Davao del Sur.

Team A is composed of Sir Edgar Bontia, LTOO IV, team leader, with Sir Astrophel Celso Gonzales, RCC III, and Ms. Lovely Facultad, LTOO II, as members.

Team B is composed of Sir Edgardo Porlares, LTOO III, team leader, with Sir Rowell Bacongco, LTOO IV, and Sir Nerf Dave Ladroma, LTOO III, as members.

From Wednesday to Friday, November 17-19, 2021, Team A audited the Municipal Treasurer’s Office of the Municipal Government of Sta. Cruz. First, the audit team paid a courtesy call to the Honorable Mayor Jaime G. Lao Jr. Present throughout the audit is Mr. Julius Caesar J. Pejo, Municipal Treasurer.